Medical Group Captive Programs

EmCap | Stop Loss Group Captive Programs

When it comes to providing employee health benefits, employers are fighting an uphill battle. With traditional health insurance, employers face increased costs every year, changing regulations, and little or no control. Employers don’t know where their health care dollars are going or how to control next year’s premium increases.

For decades, large employers have benefited from strategies that give them greater control and insight. They use proven techniques that enable them to customize their benefits, lower administrative fees and taxes, and better manage the underlying health risks. Smaller and midsize employers often can’t use these strategies, however, because they don’t have the same scale and size.

The EmCap solution from Berkley Accident and Health uses the same techniques that large employers use to manage their risk and gain control over health care costs. EmCap brings together like-minded employers to create a larger pool of employees — just like a single, large employer — and with it, greater transparency and control. This opens the door to the proven strategies that can make health care costs more stable and predictable.

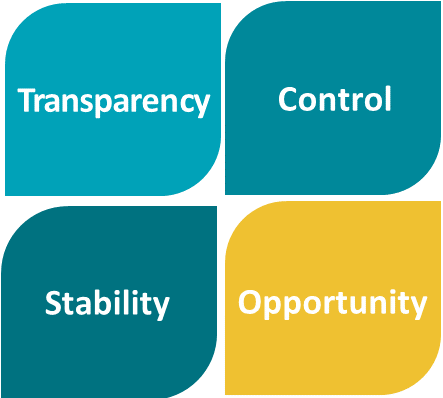

With EmCap, employers move from being buyers to owners of their health care. As owners, they enjoy data transparency, control over plan design, and stability and scale from participation in a Group Captive program. These work together to create a true opportunity for employers to manage their health plan risk.

EmCap is a financial vehicle that allows small to midsize employers to break down their health care costs into layers. Medical claims can be grouped together according to size and frequency. The vast majority of claims are small, routine claims which are predictable from year to year. Larger, more costly claims happen less frequently and are difficult to predict. EmCap works by dividing up these claims into layers to achieve maximum economic efficiency. From smallest to largest, the three layers are:

The largest and most unpredictable claims are transferred over to Berkley Life and Health Insurance Company, ensuring that the captive and all members are protected by an A+ rated carrier.

Employers share the larger, but still predictable, claims with the Group Captive program.

Employers retain this layer and pay for the small, routine medical claims themselves.

This strategy helps employers maximize the economic efficiencies of their health plan. Small risks are kept and paid for by the employer without added administrative costs. Larger risks are shared with the Group Captive program and become more predictable over the long term, due to the captive’s greater size and scale. Berkley Life and Health assumes the most catastrophic risks, thereby lowering the volatility to the captive.

“Berkley understands the captive space like no other. [They] are always looking for solutions to help with the program management.”

— Broker, Group Captives

EmCap begins with a self-funded plan — the same strategy used by large employers to provide health benefits to 67% of U.S. workers.1 With support from EmCap and direct guidance from their broker, employers create a self-funded health plan.

Employers purchase an A+ rated Employer Stop Loss policy2 with deductibles that are right for their specific risk profile.

Finally, employers join an existing Berkley Accident and Health captive program or form their own. Employers post collateral funds to the captive, which is needed if the captive’s losses are higher than expected. The captive assumes a layer of the Specific and Aggregate risk from the Stop Loss policies of its participating members. Unused funds in the captive are typically returned to the employers on a pro-rata basis.

“When I had no other solutions for insurance, Berkley’s Reference Based EmCap program allowed us to have a great insurance plan at a reduced cost.”

— Member, Reference Based EmCap Program

EmCap was developed by Berkley Accident and Health in 2008 as a first-of-its-kind approach to health plan financing. It was created by longtime industry experts with a deep understanding of alternative risk transfer and self-funding strategy.

Today, Berkley Accident and Health is a recognized leader in Stop Loss Group Captive programs. We pioneered the concept and today have one of the largest, most mature, and diverse blocks of business in the U.S. There are 1,000+ employers, representing over 250,000 employees, in our programs. We partner with existing captive programs in various domiciles and can help develop new programs through the use of simple, turnkey structures.

“We get support from other members of the captive to lean on.”

— Risk Manager, EmCap member company

The EmCap model attracts employers who want to proactively take charge of their healthcare costs. Successful EmCap members are:

Members have benefited from EmCap’s power to bring together like-minded employers all seeking the same thing — a better way to manage their health plan. They enjoy the transparency, stability, and control, as well as the financial opportunity that results.

For EmCap members and brokers by invitation only

For brokers and consultants

EmCap is not suitable for every company. Employers should always consult with their benefits advisor before making any change to their health plan.

1 2025 Employer Health Benefits Survey, Kaiser Family Foundation, www.kff.org.

2 Coverage underwritten by Berkley Life and Health Insurance Company and/or StarNet Insurance Company, both rated A+ (Superior) by A.M. Best.