Navigating rising health care costs can be a significant challenge for companies, especially small and midsize employers. At Berkley Accident and Health, we are committed to helping companies offer affordable, quality health benefits through Group Captive programs. Group Captive programs offer a way for small and midsize firms to self-fund, just like large corporations do.

To validate their effectiveness, we conducted a comprehensive impact study on our Group Captive programs. We sat down with Tom Skurat, Chief Actuary of Berkley Accident and Health, to discuss our findings.

More than 15 years ago, we began with a theory: Group Captive programs could make self-funding a viable option for small and midsize employers by reducing the year-over-year stop loss pricing volatility that can hammer their budgets. So we wanted to validate this theory with hard data, showcasing the potential for reduced volatility and lower overall costs. This impact study was crucial for us to quantify the effectiveness of our theory and show that what we were doing really helped our clients.

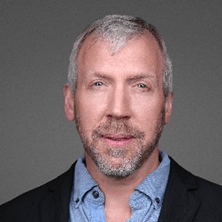

When you self-fund on your own, you’re subject to potential rate fluctuations from year to year. While a large company can weather these ups and downs, it can be harder for small and midsize companies to do so.

Volatility is a critical metric because it measures the stability of Stop Loss rates and our clients’ ability to plan for the future. Lower volatility means more predictable costs, which is especially important to small and midsize employers, who don’t have the financial resources of larger companies. Our findings show that Group Captive programs smooth annual cost fluctuations on average, acting as a shock absorber if you will, and putting self-funding within reach of more small and midsize firms.

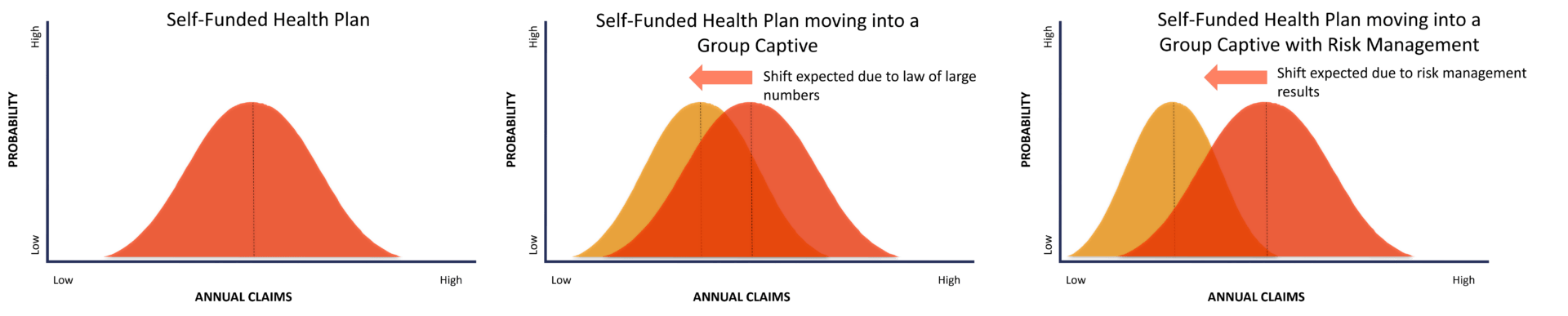

Our data goes back to 2009 and represents the historical results of 3,399 policyholders, both regular Stop Loss policyholders and those in a Group Captive program. The study revealed that most employers in Berkley’s Group Captive programs experienced lower and less volatile Stop Loss renewals, better claims outcomes, and sustained long-term benefits than our regular self-funded employers who were not in a Captive program.

It comes down to setting expectations. When switching to a self-funded plan or joining a Group Captive program, it’s important for companies to know what to expect. This helps with long-term planning and budgeting. For our captive programs, we have statistical proof that the range of expected Stop Loss renewal increases are less volatile and easier to project, because of their lower standard deviation.

Standard deviation is a measure of how dispersed the data is in relation to the average. A high standard deviation means the data is really spread out. A low standard deviation means the data is clustered tightly around the average.

Our study found that average Stop Loss renewal increases were significantly lower over time and less volatile. The majority of members saw increases in the 0% to <10% range.

Specific Stop Loss renewal increases for policyholders in an EmCap program vs. those not in an EmCap program, from 1/1/20 to 1/1/24.

I believe volatility tells you more about the success of a program than those other metrics. Return of surplus or premium is important consideration, but ideally, you want your premiums to be priced for breakeven, rather than inflating them so a portion can be returned at the end of the year. To me, that’s like overpaying on your taxes just so you can get a big refund – why give the government a free loan all year?

Likewise, the size of a program is important, too, but doesn’t tell the whole story. You do want a critical mass to create that stability, but you also want prospective members to be carefully vetted, so the program has a high-quality membership. Ideally, you want slow, steady growth of financially secure members to increase the scale of the program.

We also found members in our captive programs had:

Captive ceded premiums available for return to members in EmCap programs, on average from 2009 to 2023.

3. Consistently exceed financial expectations

Based on ceded layer loss ratios of active programs from 1/1/09-12/31/23 with at least 3 years of experience. Those that outperformed financial expectations had loss ratios of 98% or lower; those that met had loss ratios between 98.1% and 101.9%; and those that underperformed had loss ratios of 102% or higher.

4. Fewer high-dollar (over $250,000) claims

Average incidence of $250,000+ claims per 10,000 employees for policyholders in an EmCap program vs. those not in an EmCap program, from 2018 to 2022.

On average, our customers see historical savings. They have lower and more stable Stop Loss rate increases and see a lower incidence of high-dollar claims than our regular (non-captive) Stop Loss policyholders.

Why would you stay in a fully insured plan, where you’re guaranteed double digit increases every year, whether it reflects your group’s actual costs or not?

On top of the hard dollar savings, there are also the soft savings – the intangible benefits of collaboration and community in our programs. In a Group Captive program, members share best practices, benefit from greater negotiating power with point solution providers, and benefit from financial analysis from Berkley Accident and Health.

When these financial results are combined with our market-leading Stop Loss policy, it can really strengthen the long-term strategy for a self-funded employer. We have a comprehensive Stop Loss policy, with the potential to add our formal No New Special Limitations with Rate Cap endorsement and other endorsements that support our customers’ risk mitigation efforts. It all works together to give employers the peace of mind to self-fund for the long haul.

While a Group Captive programs may not be right for every employer, they offer a compelling option for those looking to take greater control of their health care spend. They make self-funding more accessible, so employers of all sizes can enjoy the benefits.

To learn more about how Berkley Accident and Health can help manage your healthcare costs, contact your local representative today.

Stop Loss is underwritten by Berkley Life and Health Insurance Company and/or StarNet Insurance Company, both member companies of W. R. Berkley Corporation and rated A+ (Superior) by A.M. Best, and involves the formation of a group captive insurance program that involves other employers and requires other legal entities. Berkley and its affiliates do not provide tax, legal, or regulatory advice concerning EmCap. You should seek appropriate tax, legal, regulatory, or other counsel regarding the EmCap program, including, but not limited to, counsel in the areas of ERISA, multiple employer welfare arrangements (MEWAs), taxation, and captives. EmCap is not available to all employers or in all states. Payment of claims under any insurance policy issued shall only be made in full compliance with all United States economic or trade and sanction laws or regulation, including, but not limited to, sanctions, laws and regulations administered and enforced by the U.S. Treasury Department’s Office of Foreign Assets Control (“OFAC”).

BAH-AD 2024-210 © Berkley Accident and Health 9/24