Medical inflation continues to outpace inflation in the rest of the economy.1 This creates headwinds for employers in every industry.

What is not as commonly known is that medical inflation affects Stop Loss carriers more severely than self-funded employers, which has a downstream impact on the Stop Loss rates.

Let’s examine why this happens and then two ways to address it – short-term fixes and long-term strategies.

Leveraged Trend – Or Why Not All Medical Inflation is Created Equal

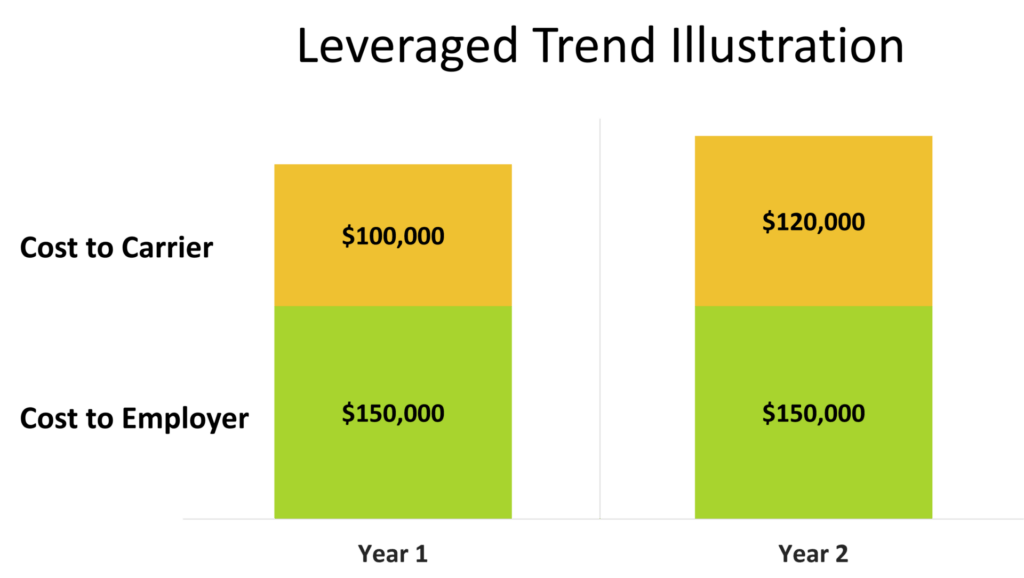

When medical costs are rising, there is a disproportionate effect on the risk transferred to the Stop Loss carrier than the risk kept by the employer, all other things being equal. This effect is called “leveraged trend.” This concept can be hard to grasp, so let’s unpack it:

- An employer has a Specific Stop Loss deductible of $150,000 and has a $250,000 claim. Under the terms of their policy, the employer is responsible for the first $150,000, and the Stop Loss carrier reimburses the plan for the remaining $100,000. So far, so clear.

- The next year, let’s assume medical costs increase by 8% and the same claim occurs again. The $250,000 claim has grown to $270,000.

- Let’s see how this plays out: the employer’s claim costs are flat, but the Stop Loss carrier’s claim costs have gone up by 20%.

In periods of medical inflation, there is a skewed impact where the Stop Loss carrier absorbs more of the claim costs than the employer.

As a result, carriers must increase rates by more than medical trend just to break even.

One thing to keep in mind – this example is for illustrative purposes only. In reality, Stop Loss rates are based on many factors, so it’s unlikely that premiums will increase exactly as shown.

Two Short-Term Fixes for Leveraged Trend

There are two ways to address the leveraged trend effect that can have immediate results:

- Increase the Specific Stop Loss deductible

Simply by working with their broker and Stop Loss carrier, employers can take on slightly more risk. In our first example, raising the Specific deductible by 4% in Year 2 to $156,000 (in pace with medical inflation) would lower the Stop Loss carrier’s increased exposure from 20% to 14%.

Experienced Stop Loss providers work with their broker partners and policyholders every year to adjust deductibles in this way, to ensure accurate, fair pricing of risk and to match risk exposure to the policyholder’s goals.

- Incorporate an Aggregating Specific deductible

Similar to raising the Specific deductible, employers can take on more risk in exchange for lower premiums by adding an Aggregating Specific deductible. This is a second deductible, in addition to the Specific deductible that is already in place. Specific claims accumulate (“aggregate”) and the deductible must be met before the policyholder can be reimbursed.

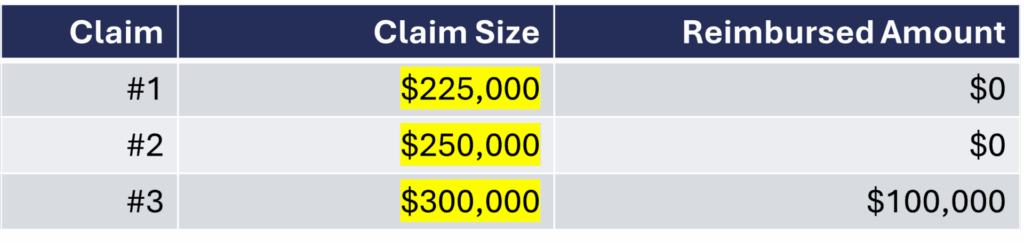

For example, if an employer has a Specific deductible of $200,000 and an Aggregating Specific deductible of $75,000, the following scenario could occur:

As you can see, the increased liability is used up by the first two claims, meaning the Aggregating Specific deductible is met when the third claim occurs. One advantage of this is that if the aggregating specific deductible is not fully used up, the policyholder gets a lower premium without paying for all the extra financial exposure.

Long-Term Strategies to Address Leveraged Trend

- Manage plan costs through health risk management

One of the advantages of self-funding is the ability to monitor cost drivers and address them with targeted risk management strategies. Employers can work with their broker and TPA to integrate services that are designed to deliver cost savings and better benefits to their employees. If large claim costs can be controlled, it can help to bend the leveraged trend curve, reducing direct and indirect exposure to high medical costs.

- Ensure the right plan and network incentives are in place

If the health plan includes an out-of-pocket maximum, thereby capping an employee’s liability, the employer should make sure there are strong incentives to seek in-network care. For out-of-network care, employers can use Centers of Excellence for high-cost care and differentiate cost-sharing structures to encourage employees to seek the right care at the right cost.

In addition, network discounts can play a role in managing leveraged trend – and some discount structures can actually exacerbate it. Network discounts are structured as aggregate numbers, but specific rates vary by service. A 25% discount does not always mean that all services are discounted by 25%: it can mean that the overall network discount averages out to 25%. Some networks have different discounts for larger claims, with permitted charges set at a higher percentage of total billed charges when costs exceed a set threshold. This is designed to provide a larger discount on smaller claims, while the discount for larger claims that hit the Stop Loss deductible are lower. While it seems like this would be a good deal for the employer, it actually exacerbates the leveraging effect of overall medical trend.

When it comes to Stop Loss renewals, there are several creative solutions to deal with leveraged trend. Working with your broker and carrier at renewal time is a smart way to deal with rising health care costs and ensure that your Stop Loss premiums fit your risk management strategy.

Contact your Berkley Accident and Health representative to learn more about how to manage leveraged trend: Find an Expert – Berkley Accident and Health

1 PWC, Behind the Numbers 2026, https://www.pwc.com/us/en/industries/health-industries/library/behind-the-numbers.html

Coverage is underwritten by Berkley Life and Health Insurance Company and/or StarNet Insurance Company, both member companies of W. R. Berkley Corporation and both rated A+ (Superior) by A.M. Best. Not all products and services may be available in all jurisdictions, and the coverage provided is subject to the actual terms and conditions of the policies issued. Payment of claims under any insurance policy issued shall only be made in full compliance with all United States economic or trade and sanction laws or regulation, including, but not limited to, sanctions, laws and regulations administered and enforced by the U.S. Treasury Department’s Office of Foreign Assets Control (“OFAC”).

BAH AD 2025-172 © Berkley Accident and Health 9/25